Before we begin

This content is for general informational purposes only. It is not intended to provide fiduciary, tax, or legal advice and cannot be used to avoid tax penalties; nor is it intended to market, promote, or recommend any tax plan or arrangement. Allianz Life Insurance Company of North America, Allianz Life Insurance Company of New York, their affiliates, and their employees and representatives do not give legal or tax advice or advice related to Medicare or Social Security benefits. You are encouraged to consult with your own legal, tax, and financial professionals for specific advice or product recommendations, or to go to your local Social Security Administration office regarding your particular situation.

Allianz, Allianz Life of NY, and Allianz Life Financial Services, LLC are affiliated companies.

- Not FDIC insured • May lose value • No bank or credit union guarantee • Not a deposit • Not insured by any federal government agency or NCUA/NCUSIF

Potential Risks and Challenges to Your Retirement Savings

When looking ahead to retirement, we all may face a number of potential risks and challenges that can chip away at our retirement savings.

Those risks include:

- Spending and life expenses (or overspending)

- Market volatility and issues related to the sequence of returns

- Catastrophic events that need insurance protection

- Potential legislative changes related to Social Security, Medicare, and potential tax law changes

- But two of those risks, the risks of inflation and the possibility of living longer than anticipated, when combined together may add even more stress to retirement savings.

Inflation

Today we are going to focus on the risks of inflation.

Inflation, which measured an average 2.18% over the past 20 years under the Consumer Price Index, can be a concern for anyone about to retire or who is retired for a number of reasons.

- First, even modest levels of inflation can have long-term effects.

Our own U.S. economic history since 1920 (last 100 years) shows an average rate of inflation at 2.73% per year. [Source: U.S. Department of Labor, Bureau of Labor Statistics, Consumer Price Index, 1920-2019.] - Even a more modest inflation rate of 2.5% means costs could double in about 28 years.

- You could potentially face problems in retirement caused by inflation. When you review the types of expenses retirees have, you see that a large portion of their expenses will be for health care. And health care expenses have been growing by much higher than average rates of inflation, as we shall see during this session. That reality means you need to confront the inflation problem, especially with regard to health care costs.

- The sooner you start to address these issues, the greater your chance of successfully managing them.

Let’s look at an overview of inflation and the historical impact it has had. We’ll then take a look at today’s economy and the impact of inflation today. We’ll consider the impact that inflation has on today’s pre-retirees and retirees and their concerns, with a special focus on rising health care costs. Then we’ll wrap up with some next steps.

We all think of inflation as a general problem of prices going up. But inflation is more than just a one-time price increase – inflation is a rise in the general level of prices sustained over time. Consequently it also means an erosion in purchasing power of your money. There are a number of theories about what causes inflation:

Milton Friedman, a Nobel Prize-winning economist, said, “Inflation is always and everywhere a monetary phenomenon.” Under this theory, inflation is caused by too much money chasing too few goods. Sometimes it is described as “demand-pull inflation.” Prices will go up when demand for an item exceeds the supply of that item. Demand increases when there is enough money in the economy to purchase the supply.

Another theory of inflation is called “cost-push” inflation. This theory is that increases in costs or a sharp drop in supply result in inflation – not excess demand.

There are theories that also blame inflation on just excess spending and even the psychological expectations of the public.

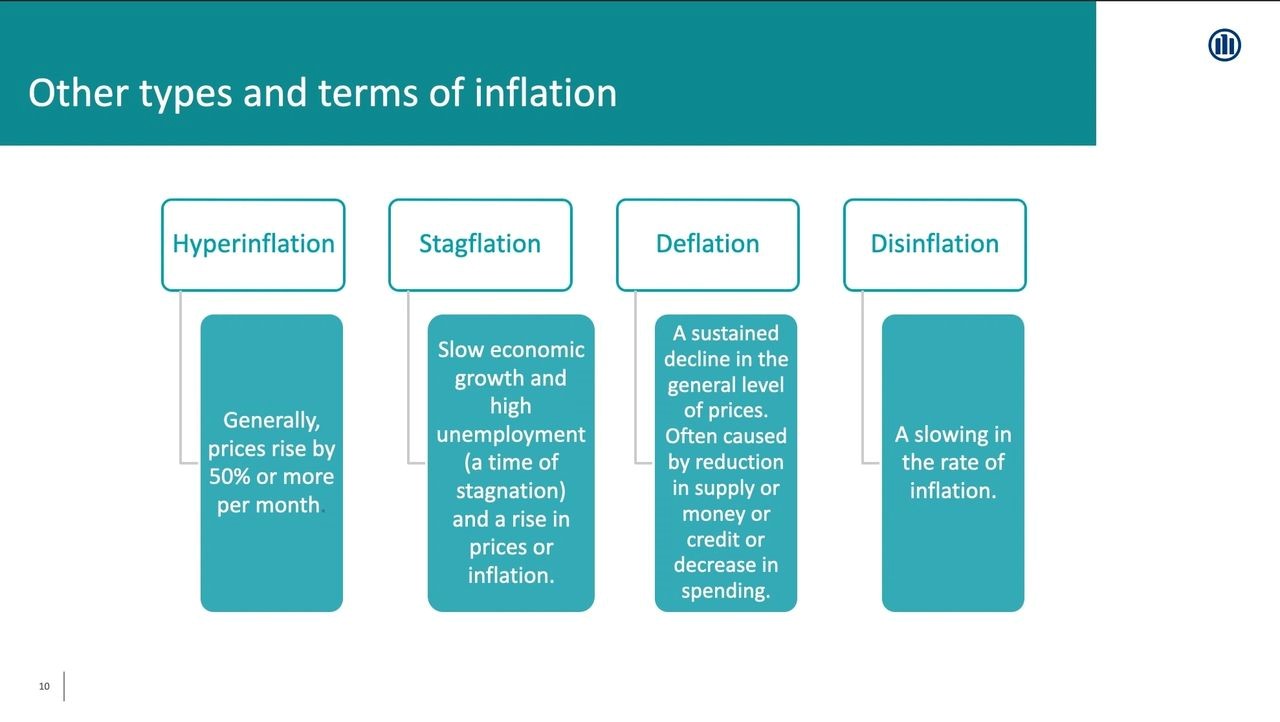

When you look at inflation, there are also other terms and types to consider.

Here are some general definitions.

Hyperinflation in general is when prices rise by 50% or more per month.

Stagflation is a weak economy and high unemployment combined with high inflation.

Deflation of course is the opposite of inflation. It is a sustained decline in the general level of prices. Keep in mind that deflation is a sustained decline in prices.

Deflation then is different from disinflation, which is the situation when the rate of inflation has fallen, and is generally not for a sustained period of time.

One of the main differences between the last two is that most definitions of deflation refer to a sustained period whereas disinflation is generally not for a sustained period.